5.1 Automatic Extensions Based on a Timely Filed Application to Renew Employment Authorization and/or Employment Authorization Document

Some noncitizens in certain employment eligibility categories who timely file Form I-765, Application for Employment Authorization, to renew their employment authorization and/or EADs may receive automatic extensions of their employment authorization and/or EADs for up to 540 days while their renewal applications remain pending.

Those who timely and properly file(d) their EAD renewal applications between May 4, 2022, and Oct. 26, 2023, or between April 8, 2024, and Sept. 30, 2025, may be eligible to receive an extension of up to 540 days as provided by temporary final rules 87 FR 26614 and 89 FR 24628. Employees who timely filed their EAD renewal applications on or after Oct. 27, 2023, but before April 8, 2024, and whose applications remain pending on or after April 8, 2024, are also eligible to receive an extension of up to 540 days as provided by 89 FR 24628. The extension begins on the “Card Expires” date on face of their EAD and generally continues for up to 540 days as applicable, or until USCIS denies the renewal application, whichever comes earliest. An automatic extension of employment authorization and/or EAD validity depends on these eligibility requirements:

- Employees must have timely and properly filed an application to renew their employment authorization and/or EAD on Form I-765, Application for Employment Authorization, before the EAD expires, and the Form I-765 EAD renewal application remains pending. Exception: Employees with EADs based on Temporary Protected Status (TPS) (A12 and C19), whose EAD renewal applications were filed during the re-registration period described in the Federal Register notice applicable to their country’s TPS designation, may receive the automatic extension, even if their renewal application was filed after the expiration date on the EAD.

- The eligibility category on the front of the employee’s EAD must have the same eligibility category as the employee’s Form I-797C, Notice of Action, issued for the corresponding EAD renewal application. Exceptions:

- In the case of an EAD and I-797C, Notice of Action, where each contains either an A12 or C19 TPS category code, the category codes do not have to match.

- For H-4 (C26), E (A17) and L-2 (A18) dependent spouses, an unexpired Form I-94 indicating H-4, E, or L-2 nonimmigrant status, including E-1S, E-2S, E-3S and L-2S class of admission codes, must accompany Form I-797C.

- Employees must have one of these qualifying eligibility categories to receive an automatic extension of their employment authorization and/or EAD validity: A03, A05, A07, A08, A10, A17*, A18*, C08, C09, C10, C16, C20, C22, C24, C26*, C31, and A12 or C19. The eligibility categories are published on the USCIS Automatic EAD Extension page. Some category codes on the EAD may include the letter ‘P’ such as C09P. Employers should disregard the letter ‘P’ when comparing the category code on the EAD with the category code on the Form I-797C, Notice of Action. *There are limitations on employees who file a Form I-765 renewal application within categories A17, A18, and C26 for an automatic extension. See A17, A18, and C26 guidance below.

If an employee is eligible for the automatic extension, acceptable proof of employment authorization and/or EAD validity during the automatic extension period includes: an EAD that appears expired on the face of the card presented with a Form I-797C, Notice of Action, that shows a timely filed EAD renewal application in the same employment eligibility category as the EAD (except TPS-based EADs and notices, which could have A12 or C19 category codes). See Automatic EAD Extensions for Temporary Protected Status (TPS) Beneficiaries in Section 5.3 for information on TPS-based EAD automatic extensions that may not require a Form I-797C, Notice of Action, and Guidance for Employees under Category Codes A17, A18, and C26 for information about the additional unexpired Form I-94 documentation that H-4, E, and L-2 dependent spouses need to present with a Form I-797C, Notice of Action.

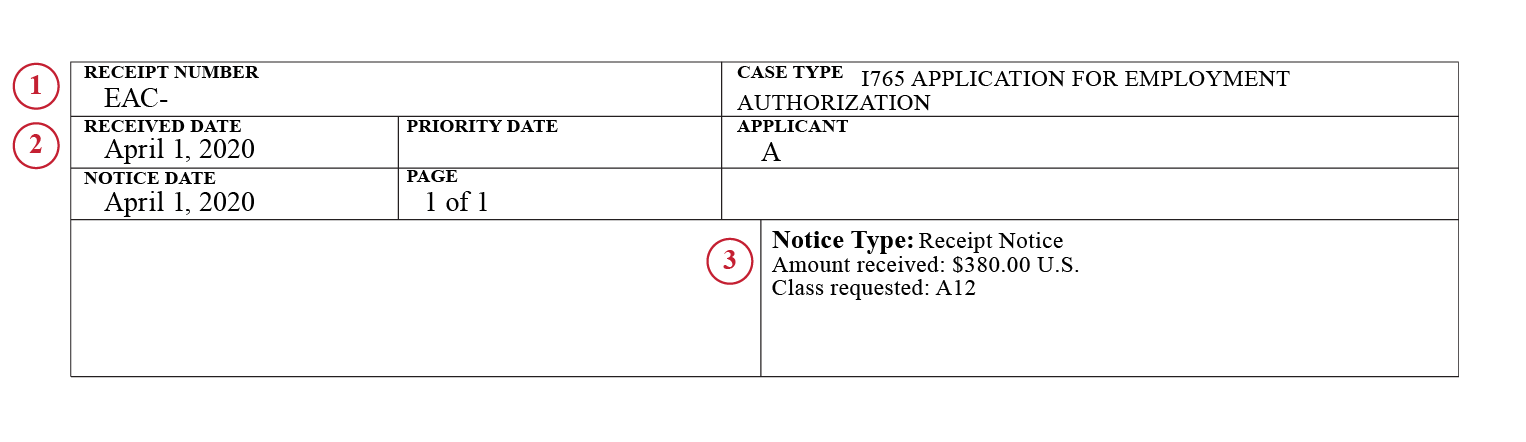

Finding Information on Form I-797C: Sample A

I-797 RECEIPT NOTICE EXEMPLAR

The receipt number appears on Form I-797C, Notice of Action, in the Receipt Number field, as noted in number 1.

The filing date (the date USCIS received the application) appears in the Received Date field, as noted in number 2. Except as explained below for TPS beneficiaries, this date should be on or before the “Card Expires” date on the EAD. Also, if the “Received Date” is between May 4, 2022, and Sept. 30, 2025, the automatic extension period is up to 540 days from the “Card Expires” date on the face of the EAD. Certain TPS beneficiaries are eligible for this extension if they have timely and properly filed to renew their EAD during the re-registration period as directed in the Federal Register Notice applicable to their country’s TPS designation. Therefore, the filing date on a TPS beneficiary’s Form I-797C might be after the “Card Expires” date on their TPS-based EAD. For more information, go to https://www.uscis.gov/humanitarian/temporary-protected-status.

The category may appear on Form I-797C in the Class Requested field, as noted in number 3. If you do not see this field, see Sample B below.

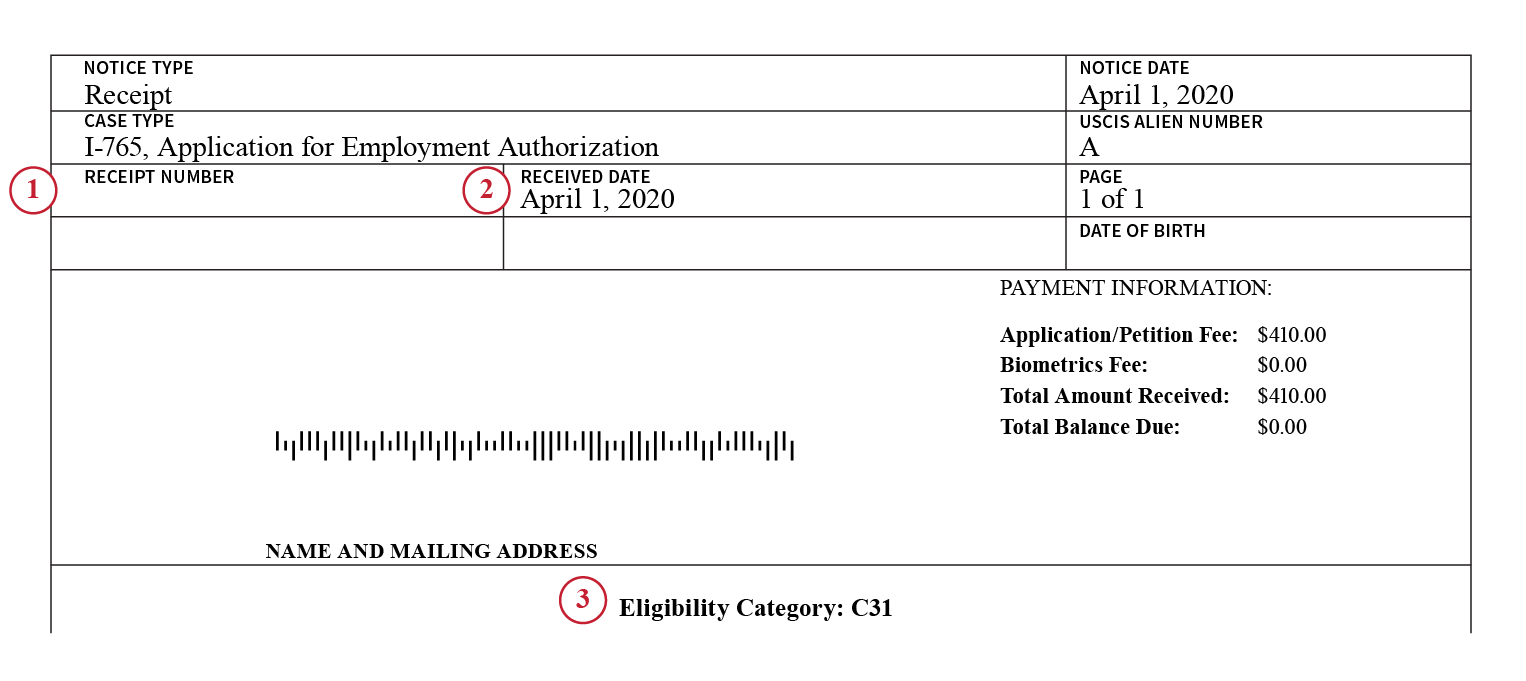

Finding Information on Form I-797C: Sample B

I-797 RECEIPT NOTICE EXEMPLAR

The receipt number appears on Form I-797C in the Receipt Number field, as noted in number 1.

The filing date (the date USCIS received the application) appears in the Received Date field, as noted in number 2. This date should be on or before the “Card Expires” date on the EAD, unless the EAD renewal application and EAD are based on TPS. For TPS-based EADs, the date may be after the “Card Expires” date on the EAD (but must be during the re-registration period stated in the applicable TPS Federal Register Notice). See Section 5.3. The category may appear on Form I-797C in the Eligible Category field, as noted in number 3. The category may appear on Form I-797C in the Eligible Category field, as noted in number 3.

How to Complete Form I-9 for EADs Automatically Extended Based on a Pending Form I-765 Renewal Application

New Employees

New employees presenting an EAD that has been automatically extended must complete Section 1 as follows:

- Select “A noncitizen authorized to work until;” and

- Enter the date that is 540 days from the “Card Expires” date on the EAD as the expiration date of employment authorization. Employees whose status does not expire, such as refugees or asylees, should enter “N/A” as the expiration date.

In Section 2, in the List A column, the employer must:

- Enter “EAD” in the Document Title field.

- Enter the Card Number from the EAD in the Document Number field.

- In the Expiration Date field, enter the date 540 days from the “Card Expires” date on the EAD if the “Received Date” on Form I-797C is between May 4, 2022, and Sept. 30, 2025.

For automatic extensions the employer should enter “EAD EXT” in the Additional Information field. Additionally, since your employee’s extension is for up to 540 days, you may keep a copy of the USCIS webpage describing the temporary extension of up to 540 days with the employee’s Form I-9.

You may use the Employment Authorization Document (EAD) Automatic Extension Calculator to determine extended expiration dates.

Rehired Employees

For employees rehired within three years from the date you completed the employee’s previous Form I-9 and who qualify for this extension, you must complete Form I-9 following the process described above or in Section 6.2. If the employee’s original Form I-9 was completed on a Form I-9 that is no longer valid, you must either complete the latest version of Form I-9 or Supplement B, Reverification and Rehire, and attach it for this employee.

Current Employees

For a current employee whose employment authorization and/or EAD has been automatically extended and who presents a Form I-797C, Notice of Action, you must update Form I-9 enter the appropriate automatic extension expiration date in the Section 2 Additional Information field. Employers should also enter “EAD EXT” in the Additional Information field and may keep a copy of the USCIS webpage describing the temporary extension of up to 540 days with the employee’s Form I-9, if applicable. If the employee’s original Form I-9 was completed on a Form I-9 that is no longer valid, enter EAD EXT and the new expiration date in the Additional Information field in Section 2 of the latest version of Form I-9 and retain it with the employee’s original Form I-9.

Guidance for Employees under Category Codes A17, A18, and C26

Employees with EADs with category codes A17, A18, and C26 require additional documentation supplementing the Form I-797C, Notice of Action, to show that the EAD has been automatically extended. These employees must present a Form I-94, Arrival/Departure record indicating unexpired nonimmigrant status (E-1, E-1S, E- 2, E-2S, E-3, E-3S, H-4, L-2 or L-2S), along with a Form I-797C, Notice of Action, that shows a timely-filed EAD renewal application stating the “Class requested” as “(A17),” “(A18),” or “(C26),” and the EAD that appears expired on the face of the card as having been issued under the same category (that is, Category A17, A18, or C26).

For a new employee, in Section 2, in the List A column, the employer must:

- Enter “EAD” in the Document Title field.

- Enter the Card Number from the EAD in the Document Number field.

- In the Expiration Date field, enter the date that is 540 days from the “Card Expires” date on the EAD if the “Received Date” on Form I-797C is between May 4, 2022, and Sept. 30, 2025, or the end date of the Form I-94, whichever is earlier.

- Enter the Form I-94 document information in the second set of List A Document entry fields.

To calculate the new expiration date:

- Add 540 to the EAD “Card Expires” date.

- Compare the 540-day auto-extended date to the Form I-94 end date.

- Whichever date is earlier is the new EAD expiration date.

The employer should enter “EAD EXT” in the Additional Information field in Section 2. If applicable, you may keep a copy of the USCIS webpage describing the temporary EAD extension of up to 540 days with the employee’s Form I-9. Employers must reverify employment authorization at the end of the automatic extension period.

Updating Form I-9 for an Employee with An Existing 180-Day Automatic Extension

If your employee’s Form I-797, Notice of Action, for their EAD renewal application has a Received Date of Oct. 27, 2023, through April 7, 2024, and refers to a 180-day extension, and the EAD renewal application is still pending on or after April 8, 2024, the employee is eligible to receive an additional extension of 360 days as provided in the temporary final rule (FR 24628), for a total of 540 days counted from the “Card Expires” date stated on the face of the EAD. Employees whose EAD Category Codes are A17, A18, and C26 may not necessarily receive the full 360-day extension, and this is explained below in the For Category Codes A17, A18, and C26 guidance.

You must update the Additional Information field in Section 2 of the employee’s Form I-9 to include the new EAD expiration date no later than the date the employee’s 180-day automatic extension will end. Employers are not required to re-examine documents; however, your employee may present a Form I-797C, Notice of Action, EAD and, if applicable, Form I-94 again if you need to re-examine the “Card Expires” date and the category code(s) to determine eligibility and/or accurately calculate the increased automatic extension.

Your employee’s Form I-797C, Notice of Action, that refers to an automatic EAD extension of up to 180 days is acceptable evidence of the extension of up to 540 days, provided the above-described eligibility requirements are satisfied.

You should update the employee’s original Form I-9 to add 360 days to the employee’s EAD 180-day automatic extension date located in Section 2. You could also determine the automatic extension date by adding 540 days to the “Card Expires” date shown on the EAD. If the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, you should enter the new EAD expiration date in the Additional Information field in Section 2 of a new Form I-9 and retain it with the employee’s original Form I-9.

Employers may keep a copy of the USCIS webpage describing the temporary EAD extension of up to 540 days with the employee’s Form I-9.

For Category Codes A17, A18, and C26

This guidance applies to employees who fall within category codes A17, A18, or C26 and therefore are either H-4, E, or L-2 dependent spouses, including E-1S, E-2S, E-3S and L-2S class of admission codes listed on Form I-94. Your employee’s automatic extension period cannot exceed the Form I-94 end date. Under this circumstance, your employee could have an extension that is greater than 180 days but less than the additional 360 days.

Your employee’s Form I-797C, Notice of Action, may refer to an automatic EAD extension of up to 180 days and is acceptable evidence of the 540-day extension, but cannot exceed the Form I-94 end date, provided the above-described eligibility requirements are satisfied.

In the Additional Information field of Section 2, you should enter either the Form I-94 end date or the EAD “Card Expires” date plus up to 360 days, whichever date is earlier. Note that if the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, you should enter the new expiration date in the Additional Information field in Section 2 of a new Form I-9, initial and date the notation, and retain it with the employee’s original Form I-9.

Reverification

You must reverify employees’ employment authorization when the automatic extension of their employment authorization and/or EAD ends (whichever is earlier). You can reverify temporary employment authorization before the automatic extension ends if an employee presents any acceptable, unexpired document that shows employment authorization, such as any acceptable document from List A or C.