EB-5 Questions and Answers

1. Can I retain eligibility under section 203(b)(5)(M) of the Immigration and Nationality Act (INA) if my regional center is terminated or my new commercial enterprise (NCE) or job-creating entity (JCE) is debarred?

Yes, in certain circumstances. The EB-5 Reform and Integrity Act of 2022 (RIA) added section 203(b)(5)(M) to the INA. The new section generally permits good-faith investors to retain their eligibility after termination of their regional center or debarment of their NCE or JCE. After we notify investors of the termination or debarment, they may retain eligibility either by notifying us that they continue to meet eligibility requirements notwithstanding the termination or debarment, or by amending their petition to show that they meet the requirements under section 203(b)(5)(M)(ii) of the INA (which has different requirements depending on whether the investor is seeking to retain eligibility because their regional center was terminated or because their NCE or JCE was debarred). However, any investor who was a knowing participant in the conduct that led to the termination or debarment may not benefit from section 203(b)(5)(M) of the INA (for example, such would be the case if the petitioner knew of fraud and failed to terminate or report an agent that is engaging in fraud for the EB-5 entity).

2. Do the investor protections under section 203(b)(5)(M) of the Immigration and Nationality Act (INA) apply to me if I filed a Form I-526 petition before enactment of the EB-5 Reform and Integrity Act of 2022 (RIA)?

Yes. To accommodate good-faith investors as envisioned by the RIA, we interpret the investor protections under INA section 203(b)(5)(M) to apply to pre-RIA investors in addition to post-RIA investors associated with a terminated regional center or debarred new commercial enterprise or job-creating entity.

3. Are all investors subject to the same eligibility requirements to retain eligibility under section 203(b)(5)(M) of the Immigration and Nationality Act (INA)?

No, because the underlying eligibility requirements for classification applicable to investors who filed petitions for classification before enactment of the EB-5 Reform and Integrity Act of 2022 (RIA) as well as the impact of certain provisions of the RIA differ from the underlying eligibility requirements for classification applicable to investors who filed petitions for classification after enactment of the RIA. We explain the differences below, starting with pre-RIA investors.

Per the INA and the RIA, including the RIA’s grandfathering provisions under Section 105(c) (which requires continued adjudication of pre-RIA petitions even before the effective date of the RIA EB-5 reforms), pre-RIA investors may continue to be eligible or retain their eligibility under INA section 203(b)(5)(M) based on the eligibility requirements applicable to them when they filed their underlying petition. Accordingly, pre-RIA investors, in certain situations, may remain eligible based on indirect jobs even if we terminate their associated regional center. Pre-RIA investors must also sustain their investment throughout the 2-year period of their conditional residency under the requirements of Section 216A of the INA as applicable to investors who filed petitions for classification before enactment of the RIA.

On the other hand, post-RIA investors are subject to the new requirements added by the RIA. For example, post-RIA regional center investors, in general, must be associated with a filed or approved project application (Form I-956F, Application for Approval of an Investment in a Commercial Enterprise). See INA sections 204(a)(1)(H)(ii) and 203(b)(5)(F). In addition, post-RIA investors’ capital is expected to remain invested for at least 2 years as required INA 203(b)(5)(A)(i) (as amended by the RIA).

4. What factors influence how I can continue to meet eligibility requirements following termination of my regional center or debarment of my new commercial enterprise or job-creating entity?

Whether an investor continues to meet eligibility requirements or may need to take different actions to retain their eligibility will depend on:

- When they filed their petitions for classification (before or after enactment of the EB-5 Reform and Integrity Act of 2022 (RIA)) because of the different requirements and legal provisions that apply to them; and

- The reasons for termination or debarment and whether the investors’ eligibility for classification has been impacted.

In general, pre-RIA investors may remain eligible if their project is complete or will be completed in accordance with the comprehensive business plan, with sufficient job creation for all investors, and the investor’s capital has been and will be sustained through the requisite 2-year sustainment period of their conditional residency. In such cases, officers may plausibly determine that a pre-RIA investor associated with the terminated regional center is still eligible for classification as an immigrant investor, even without the need to reassociate with another approved regional center or make a qualifying investment in another new commercial enterprise. Also, we generally will not consider such termination a material change that affects continued eligibility.

In general, post-RIA investors may continue to be eligible if their capital remained invested for at least 2 years after being placed at risk under applicable requirements and satisfied the job creation requirement before termination or debarment. In such cases, officers may plausibly determine that such post-RIA investors are still eligible for classification as an immigrant investor, even though the regional center was terminated and without the need to reassociate with another approved regional center or make a qualifying investment in another new commercial enterprise.

However, for both pre- and post-RIA investors, if their regional center is terminated or their new commercial enterprise or job-creating entity is debarred and their capital investment project has failed or will only create less than the requisite number of jobs, they generally will not remain eligible and may use the protections under INA 203(b)(5)(M) to amend their petition to retain eligibility. For example, where the investor’s regional center is terminated and their project has failed, they may amend their petition to retain eligibility through their new commercial enterprise reassociating with an approved regional center or by making a qualifying investment in another new commercial enterprise to ensure satisfaction of applicable requirements such as job creation.

In all cases, we will make such determinations consistent with USCIS policy about deference to prior determinations to ensure consistent adjudication.

5. If I filed a Form I-526E, Immigrant Petition by Regional Center Investor, after enactment of the EB-5 Reform and Integrity Act of 2022, what happens to the Form I-956F, Application for Approval of an Investment in a Commercial Enterprise, associated with my petition when my regional center is terminated?

After we terminate a regional center’s designation, we will revoke any Form I-956F, Application for Approval of an Investment in a Commercial Enterprise, associated with the terminated regional center if the Form I-956F was approved as of the date on the regional center’s termination notice. We will deny any Form I-956F pending on the date of the termination notice or those the terminated regional center submits after the date of the notice. You may continue to be eligible notwithstanding the termination of your regional center where sufficient jobs were already created and your capital was invested for at least 2 years under applicable requirements before the termination of your regional center and subsequent denial or revocation of the associated Form I-956F. If that is not the case, you may amend your petition to remain eligible and demonstrate that your new commercial enterprise has reassociated with an approved regional center or that you have made a qualifying investment in another new commercial enterprise as your Form I-526E must continue to be associated with a pending or approved Form I-956F application.

6. How will I be notified of the termination of my regional center or the debarment of my new commercial enterprise or job-creating entity?

After we terminate the designation of a regional center or debar a new commercial enterprise or job-creating entity, we identify the investors and generally issue them a Notice of Regional Center Termination or Notice of Debarment. If you receive a notice, we identified you as an affected investor.

7. How long do I have to respond to the Notice of Regional Center Termination or Debarment?

As provided under section 203(b)(5)(M)(iii) of the Immigration and Nationality Act (INA), you generally must respond to the Notice of Regional Center Termination or Debarment of your new commercial enterprise (NCE) or job-creating entity within 180 days to either notify us that you continue to be eligible notwithstanding the termination or debarment or to amend your I-526E, Immigrant Petition by Regional Center Investor, to retain eligibility under section 203(b)(5)(M)(ii) of the INA (such as by your NCE reassociating with an approved regional center or by you making a qualifying investment in another NCE). Rather than strictly applying the notification timeframes under INA 203(b)(5)(M), we generally will extend the deadline for pre-RIA investors to respond to such notices until we adjudicate their Form I-526, Immigrant Petition by Standalone Investor.

8. What information is included in the Notice of Regional Center Termination or Debarment?

The Notice of Regional Center Termination will identify the terminated regional center and its date of termination. Similarly, the Notice of Debarment of a new commercial enterprise or job-creating entity will identify the debarred entity and its date of debarment. The Notice of Regional Center Termination or Debarment will also include information on where and how to submit a response, if needed, and a deadline for responding.

9. How do I show that my new commercial enterprise has reassociated with an approved regional center?

Evidence of reassociation may include a new regional center affiliation agreement documenting the change and updated offering documents.

Investors who filed petitions for classification before enactment of the EB-5 Reform and Integrity Act of 2022 (RIA) may submit evidence of reassociation through the process identified in the Notice of Regional Center Termination or Debarment.

Post-RIA investors must file an amendment to Form I-526E, Immigrant Petition by Regional Center Investor, documenting the reassociation with an approved regional center in response to the Notice of Regional Center Termination or Debarment. Post-RIA investors filing a Form I-526E amendment are not required to submit another $1,000 EB-5 Integrity Fund petition fee, which is only required with initial Form I-526E filings.

10. How do I show that I have made a qualifying investment in another new commercial enterprise (NCE)?

Evidence of qualifying investment in another NCE may include a subscription agreement, private placement memorandum, business plan, economic impact analysis, bank statements, wire transfers and any other evidence applicable to establish that the investment is qualifying (including that it was derived from a lawful source).

Investors who filed petitions for classification before enactment of the EB-5 Reform and Integrity Act of 2022 (RIA) may submit evidence of qualifying investment in another NCE through the process identified in the Notice of Regional Center Termination.

Post-RIA investors must file an amendment to Form I-526E, Immigrant Petition by Regional Center Investor, documenting the qualifying investment in another NCE. Post-RIA investors filing a Form I-526E amendment are not required to submit the $1,000 EB-5 Integrity Fund fee, which is only required with initial Form I-526E filings.

11. Can I make other changes to my petition when I amend my petition because my new commercial enterprise (NCE) has reassociated with an approved regional center or I have made a qualifying investment in another NCE?

Yes. Based on section 203(b)(5)(M)(iii)(II)(aa) of the Immigration and Nationality Act (INA), amendments to business plans are permitted and recovered capital can be considered the investor’s capital per section 203(b)(5)(M)(iii)(II)(bb) of the INA. Investment of additional capital may be permitted under INA 203(b)(5)(M)(ii) to the extent it needs to be “qualifying” based on the amount required for the new NCE (for example, where the new NCE is not in a targeted employment area) or when necessary to satisfy remaining job creation.

12. Can I make additional changes to my petition after I respond to a Notice of Regional Center Termination?

Generally, no. Once you have responded within 180 days to the notice and identified that you either remain eligible notwithstanding the termination or debarment or that you are amending your petition based on the reassociation of your new commercial enterprise (NCE) with an approved regional center or you having made a qualifying investment in another NCE, you generally may not further amend your petition in order to retain eligibility on another basis.

13. If I filed my Form I-526 before enactment of the EB-5 Reform and Integrity Act of 2022 (RIA) and make a qualifying investment in another new commercial enterprise, do I have to increase my investment to the new statutory amount?

No. The required amount for a qualifying investment under section 203(b)(5)(M) of the Immigration and Nationality Act (INA) is based on the requirement as of the original filing date of the underlying petition. Therefore, if you filed your Form I-526, Immigrant Petition by Standalone Investor, before March 15, 2022, and are seeking to retain eligibility under section 203(b)(5)(M) of the INA based on a qualifying investment in another new commercial enterprise, you must invest either the pre-RIA standard amount of $1,000,000 or the reduced amount of $500,000 if your investment is in a targeted employment area.

14. Can I request that my regional center be terminated?

No. We have the sole authority to issue terminations under applicable authorities. Investors (as well as new commercial enterprises and job-creating entities) cannot request a voluntary termination, although an individual or entity may request to withdraw their petition or application consistent with existing procedures. However, regional centers may withdraw from the EB-5 Regional Center Program and request termination of their designation (see Title 8 of the Code of Federal Regulations, section 204.6(m)(6)(vi)).

15. Can I request debarment of my new commercial enterprise (NCE) or job-creating entity (JCE)?

No. We have the sole authority to issue debarments under applicable authorities. Investors (as well as NCEs, JCEs, and regional centers) cannot request a voluntary debarment of an associated NCE or JCE.

16. Can I retain eligibility under section 203(b)(5)(M) of the Immigration and Nationality Act (INA) if my project failed but my regional center has not been terminated or my new commercial enterprise (NCE) or job-creating entity (JCE) has not been debarred?

No. An immigrant investor can only retain eligibility under section 203(b)(5)(M) of the INA if we terminate their regional center or debar their NCE or JCE. Project failure, on its own, is not an applicable basis to retain eligibility under section 203(b)(5)(M) of the INA. If you wish to have your NCE reassociate with another regional center or make a qualifying investment in NCE because of a project failure separate from termination or debarment, you must file a new petition for classification based on post-RIA eligibility requirements.

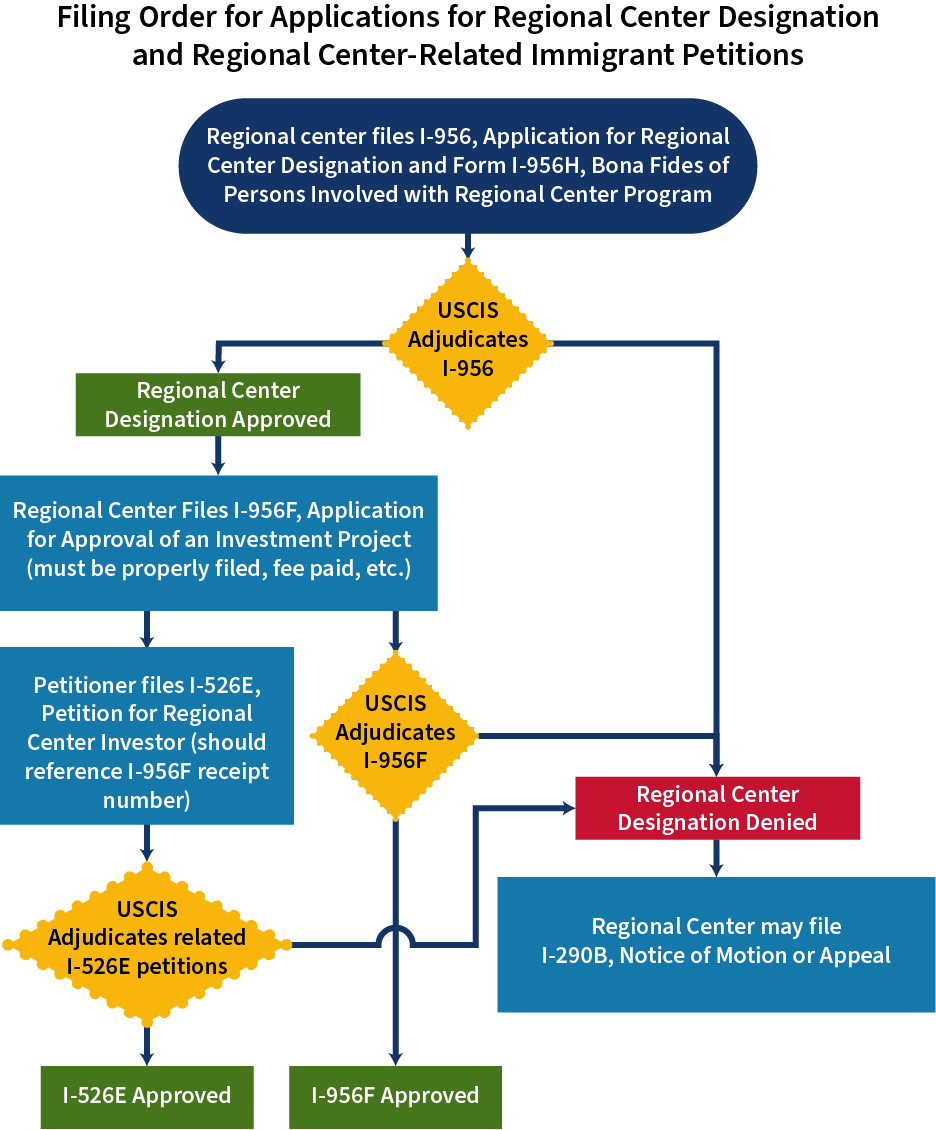

1. Is there a specific order for filing applications for regional center designation, applications for investment projects, and immigrant petitions for investors in regional center projects?

Yes. Before a regional center can file for approval of an investment project, the regional center must first have an approved application for designation, which includes approved designations before enactment of the EB-5 Reform and Integrity Act of 2022.

An entity seeking regional center designation must apply for such designation under the EB-5 Regional Center Program on Form I-956, Application for Regional Center Designation, with the appropriate fee. The Form I-956 application must include a Form I-956H, Bona Fides of Persons Involved with Regional Center Program for each person involved with the regional center. On the form, each person attests, and provides information to confirm, that they are in compliance with section 203(b)(5)(H) of the Immigration and Nationality Act.

Once we approve the regional center’s designation application, the regional center will need to file a Form I-956F, Application for Approval of an Investment in a Commercial Enterprise, for each particular investment offering through a new commercial enterprise that the regional center intends to sponsor. A regional center that was previously designated and that is filing an amendment application to demonstrate the regional center’s eligibility for continued designation under the new statute may file an investment project application before we approve the amendment application. The Form I-956F application must include a Form I-956H for each person involved with the new commercial enterprise or affiliated job-creating entity. On the form, each person attests, and provides information to confirm, that they are in compliance with program requirements.

After the regional center has properly filed a Form I-956F (but without it needing to be approved), an investor in that specific investment offering may file an individual Form I-526E, Immigrant Petition by Regional Center Investor.

2. Can pre-RIA investors retain their eligibility if their regional center is terminated?

Given the large volume of investors that could be affected by terminations of previously designated regional centers based solely on noncompliance with certain new administrative requirements added by the RIA, such as paying the annual Integrity Fund fee, we interpret the RIA in a manner we hope permits good faith investors of terminated regional centers to retain their eligibility.

To accommodate these good faith investors as envisioned by RIA, we interpret INA 203(b)(5)(M) to apply to pre-RIA investors associated with a terminated regional center (or debarred new commercial enterprise or job-creating entity). INA 203(b)(5)(m)(v)(II) authorizes the secretary of homeland security to “extend any applicable deadlines under this paragraph.” Therefore, rather than strictly applying the notification timeframes under 8 USC 1153: Allocation of immigrant visas, we will generally extend the deadline for pre-RIA investors to respond to a regional center termination notification until we adjudicate their petition. At the time of adjudication, if we need more information from the investor about eligibility, the officer may issue a request for evidence or a notice of intent to deny, giving the investor an opportunity to establish their eligibility.

To satisfy the eligibility requirements applicable to pre-RIA investors, such investors may rely on the RIA’s grandfathering provisions under Section 105(c) (which requires continued adjudication of pre-RIA petitions even before the effective date of the codification of the reformed program into the INA) for purposes of continued eligibility.

Therefore, pre-RIA investors may, in certain situations, remain eligible based on indirect jobs, as applicable to their petition before the RIA was enacted notwithstanding termination of their associated regional center. Accordingly, where regional center termination is based on purely administrative noncompliance that does not otherwise directly affect or implicate the underlying investment or job creation, officers may generally determine, in their discretion and on a case-by-case basis, that a pre-RIA investor associated with the terminated regional center continues to be eligible for classification as an immigrant investor, notwithstanding the regional center termination.

However, we do not interpret the grandfathering provision of Section 105(c) of the RIA to apply to post-RIA investors, who are subject to the new requirements added by the RIA, such as the requirement under INA 204(a)(1)(H)(ii) to remain associated with an approved project application under INA 203(b)(5)(F). This interpretation of the grandfathering provision of Sec. 105(c) accords with the statement from Sen. Chuck Grassley, one of the primary authors of the RIA, in explaining the intent of the RIA that “the bill allows petitions filed by immigrant investors under the old pilot program to continue to be adjudicated under the law as it existed when they were filed.” 168 Cong. Rec. S1105 (daily ed. March 10, 2022).

3. Do regional centers that properly filed the Forms I-956 and/or I-956G versions in effect on the filing date need to refile any new form published after the date they filed?

Regional centers will not have to file an updated Form I-956 or Form I-956G due to revisions to the form or the form instructions that were published after the date the regional center filed their Form I-956 or I-956G.

Regional centers should ensure that they are using the most up-to-date version of each form at the time of submission. More information and filing instructions and form editions can be found on our website landing pages for Form I-956 and Form I-956G.

4. Will USCIS allow regional centers to supplement any filed Form I-956G with additional information requested?

Regional centers use Form I-956G to provide required information, certifications, and evidence to support their continued eligibility for regional center designation. The form allows regional centers to amend or supplement a previously filed Form I-956G when we determine or the regional center determines that the previously filed Form I-956G submission is insufficient.

If we determine that the information provided on the Form I-956G is insufficient, we may issue a Request for Information, Request for Evidence, or a Notice of Intent to Terminate.

Regional centers should respond to the Request for Information, the Request for Evidence, or the Notice of Intent to Terminate with the information requested.

5. What is the status of USCIS’s review of initial Form I-956 and amendments?

We began reviewing and adjudicating Forms I-956 after the form was published in May 2022. We continue to review and adjudicate Form I-956 initial applications and amendments.

6. USCIS suggested in response to comments to the Form I-956F that regional centers can interfile any non-material updates to the application while the application is pending adjudication. Before the RIA, any such updates could be incorporated directly into the investors’ Form I-526 petitions. Can USCIS clarify if non-material updates to pending I-956Fs can be interfiled and will not require a new filing?

Nonmaterial updates to pending I-956Fs can be interfiled and do not require a new filing.

7. When must a regional center file a Form I-956 amendment?

According to INA 203(b)(5)(E)(vi), a designated regional center must file a Form I-956 amendment not later than 120 days before the implementation of significant proposed changes to its organizational structure, ownership, or administration, including the sale of such center, or other arrangements which would result in individuals not previously subject to the requirements under INA 203(b)(5) (H) becoming involved with the regional center.

Regional centers must also file a Form I-956 amendment if they are requesting any changes to their approved geographic area or the regional center’s name.

8. Are all regional centers—newly designated as well as previously designated—subject to the new provisions of the INA added by the RIA?

All regional centers—newly designated as well as previously designated—are subject to the new provisions of the INA added by the RIA because the only existing statutory authority under which a regional center may be designated for participation in the regional center program is INA 203(b)(5)(E) following repeal of the former authorizing statute. This is true regardless of whether the designated regional center intends to promote new projects for new investors under the reformed regional center program.

We continue to apply the new provisions of the INA added by the RIA to all regional centers, including those designated before the RIA as contemplated by the Behring preliminary injunction and settlement.

9. When is the annual Integrity Fund Fee due and what amounts should regional centers pay?

Per INA 203(b)(5)(J)(II)(i), on Oct. 1, 2022, and each Oct. 1 thereafter, each regional center must pay into the Integrity Fund. We announced via Federal Register Notice that the first fee payments were due beginning on March 2, 2023. 88 Fed. Reg. 13141. The payment amount required depends on the number of investors under the sponsorship of all the regional center’s new commercial enterprises in the preceding fiscal year.

Regional centers must pay $20,000 if they have 21 or more total investors in the preceding fiscal year in their new commercial enterprises. Regional centers must pay $10,000 if they have 20 or fewer total investors in the preceding fiscal year in their new commercial enterprises.

We will terminate the designation of any regional center that does not pay the fee required within 90 days after the date on which such fee is due.

For more information, visit the following web pages:

USCIS to Start Collecting Fee for EB-5 Integrity Fund | USCIS

Federal Register Notice of EB-5 Regional Center Integrity Fund Fee

10. How do I properly file my Form I-956H, Bona Fides of Person Involved with Regional Center Program?

All Forms I-956H must be properly filed by mailing the forms to the appropriate mailing address that is provided on the USCIS website at uscis.gov/i-956h.

This includes the submission of any Form I-956H accompanying the regional center’s Form I-956 and Form I-956F filing as well as any Form I-956H filed in response to a USCIS notice, such as a Request for Evidence (RFE) or a Notice of Intent to Deny (NOID).

If we request additional Forms I-956H, regional centers still should file the additional Forms I-956H according to the proper mailing instructions provided on the form instructions. If you send your Form I-956H to the Investor Program Office in Washington, D.C., as exhibits to your response, we may reject the form. Such rejections may result in the delay of reviewing the response and adjudicating the associated Form I-956 or I-956F application.

With the response, regional centers should indicate in their cover letter the names of all persons for whom a Form I-956H was submitted and that all requested Forms I-956H have been properly submitted according to the form instructions.

11. Why was I scheduled for my biometrics appointment at an application support center far from where I live?

We schedule biometrics appointments at the closest application support center to the address provided in Part 3, Question 15, of Form I-956H.

Therefore, individuals should provide their personal mailing address and not the attorney’s or regional center entity’s address. Providing the correct mailing address will help prevent unnecessary cancellations or rescheduling of the biometrics appointments, which delays the adjudication of the associated Form I-956 or Form I-956F application.

12. What entity name and identification number should I put in the chart in Part 2 of the Form I-956H if I am involved with multiple EB-5 entities?

The name and identification number of the specific entity (regional center, new commercial enterprise (NCE), and job creating entity (JCE)) that the person is involved with for that particular Form I-956H filing that will be filed with an associated Form I-956 (for involvement in a regional center) or Form I-956F (for involvement in a NCE or affiliated JCE). Individuals must submit more than one Form I-956H if they are involved with more than one entity, as explained below.

Specifically, each person involved with a regional center must complete Form I-956H, Bona Fides of Persons Involved with Regional Center Program, to be submitted with the regional center’s Form I-956, Application for Regional Center Designation.

If you are filing a Form I-956H due to your role in the regional center entity, you must provide the regional center name, any other names the regional center is authorized to use, and regional center identification number. Do NOT provide the names of any new commercial enterprise(s) (NCE) or the job-creating entity(ies) (JCE) on this chart even if you are involved with an associated NCE or JCE in some capacity.

Each person involved with an NCE and/or an affiliated JCE must complete Form I-956H to be submitted with Form I-956F, Application for Approval of Investment in a Commercial Enterprise, for those specific entities. A person involved with the regional center who previously filed Form I-956H with the Form I-956 must also file Form I-956H with the Form I-956F if that person is involved with the NCE or affiliated JCE.

Therefore, persons involved with an NCE or affiliated JCE will provide the NCE and JCE names, any other names used (for example, d/b/a), and any associated identification numbers on the Form I-956H submitted with the Form I-956F. Likewise, persons should not include the name or identification number of the regional center entity on the chart if they are submitting the Form I-956H due to their role in the NCE or JCE.

13. How should I format regional center identification numbers, new commercial enterprise ID numbers, application receipt numbers, and petition receipt numbers when completing Investor Program applications and petitions?

We assign a receipt number with the INF- prefix to all regional center-related applications that were submitted before the EB-5 Reform and Integrity Act of 2022 (RIA). We do this for all Form I-956 applications for initial designation and amendments, Form I-956G annual statements, and Form I-956F project applications. Form I-526E and Form I-829 petitions related to a regional center will have one of two prefixes, WAC or IOE, depending on when they were submitted: petitions submitted before the 2022 RIA will have the WAC prefix, and petitions submitted after the 2022 RIA will have the IOE prefix.

Regional center ID numbers always begin with either the RC prefix or, for cases after the enactment of the 2022 RIA, an ID prefix. These prefixes are separate from the receipt number and are not interchangeable with the receipt number.

Initially, pre-RIA regional centers will keep the ID prefix, but once the regional center files an initial Form I-956 or a Form I-956 amendment and we have approved it, we will permanently assign the regional center a new regional center ID number with the RC prefix. Identification numbers for new commercial enterprises (NCE) always start with the NCE- prefix.

Once established with the initial filing for the regional center or NCE, the regional center and NCE identification numbers will generally stay the same throughout the business life of the regional center or NCE.

Please do not use spaces, dashes, or letters—other than the two- or three-letter prefixes followed by the numbers, as described above—when entering receipt numbers or regional center or NCE ID numbers into any regional center-related application, petition, or any correspondence to USCIS.

It is crucial that you enter these prefixes and numbers accurately so our automated systems can accept the EB-5 cases properly, which, in turn, will help us efficiently process EB-5 petitions and applications.

Attorneys filing regional center-related petitions or applications should typically include the full regional center name and NCE name (if applicable) in the header of their attorney cover letters and, if known at the time of filing, the regional center and NCE identification numbers.

Receipt Number Format

| Form Type | Pre-RIA Prefix | Post-RIA Prefix |

| I-526 | WAC | IOE |

| I-526E | N/A | IOE |

| I-956/I-956H/I-956F/I-956G/I-956K | N/A | INF |

Entity Identification Number Format

| Entity Type | Pre-RIA Prefix | Post-RIA Prefix |

| Regional Center (RC) | ID | RC |

| New Commercial Enterprise (NCE) | NCE | NCE |

| Job Creating Entity (JCE) | JCE | JCE |

14. How can an approved regional center that does not wish to continue participation in the Regional Center Program withdraw from the Regional Center Program?

The EB-5 Reform and Integrity Act of 2022 (RIA) did not change the process for withdrawing from the Regional Center Program and requesting a termination of a regional center designation. When an approved regional center does not want to continue participating in the Regional Center Program for any reason, a regional center may withdraw from the program and request a termination of its regional center designation pursuant to 8 CFR 204.6(m)(6)(vi). The regional center must notify USCIS of its withdrawal in the form of a letter or as otherwise requested by USCIS. Once USCIS receives a termination request is received, we will evaluate the request and notify the regional center of our decision on the termination request in writing.

Regional centers can mail the letter to:

U.S. Citizenship and Immigration Services

Immigrant Investor Program Office,

131 M Street, NE, 3rd Floor, Mailstop 2235,

Washington, DC 20529

Or the regional center can email the letter to:

uscis.immigrantinvestorprogram@uscis.dhs.gov

15. Where can I find information about approved or terminated regional centers and the reasons for termination?

We publish a list of approved and terminated regional centers on our website. In addition, USCIS publishes termination notices that are final agency actions in the electronic reading room.

- USCIS approved regional centers

- USCIS terminated regional centers

- USCIS regional center termination notices

16. Do all designated Regional Centers, including those approved prior to March 15, 2022, need to file an I-956G by December 29?

Yes, INA 203(b)(5)(G) requires that each designated regional center shall submit an annual statement, in a manner prescribed by the Secretary of Homeland Security. The Secretary has designated the Form I-956G, Regional Center Annual Statement, as the manner to collect this information. The instructions for the Form I-956G implement the statutory requirement and provide that each approved regional center must file Form I-956G for each federal fiscal year (Oct. 1 through Sept. 30) on or before Dec. 29 of the calendar year in which the federal fiscal year ended. It’s important to note that these dates relate to regional center designation. If a regional center is designated but has a pending amendment, they still need to file the Form I-956G. Form I-956G and its filing requirements were published in the Federal Register on Sept. 2, 2022, 87 FR 54233. Following public notice and comment, Form I-956G was approved by OMB on July 24, 2023, and subsequently published for use by USCIS. USCIS has also mentioned the filing requirements previously at stakeholder engagements as well as via alerts on our website, including most recently at the Oct. 30, 2023, joint engagement with the CIS Ombudsman and the Nov. 6, 2023, alert on the USCIS website.

For regional centers that fail to file Form I-956G by the required filing date, INA 203(b)(5)(G)(iii) states that USCIS shall sanction designated regional centers that do not file the required annual statement (which DHS designated as Form I-956G). In accordance with this statutory directive, USCIS will sanction regional centers who fail to comply with the requirement to file their Form I-956G, up to and including termination from the Regional Center Program.

1. What is the legal basis that invested capital needs to remain invested for at least 2 years only for investors who filed an I-526 or I-526E petitions after enactment of the RIA?

On March 15, 2022, President Biden signed the EB-5 Reform and Integrity Act of 2022 (RIA) as part of the Consolidated Appropriations Act. This statue reauthorized the Regional Center Program, enacted significant integrity reforms to the EB-5 Program, and, among other things, modified the requirements regarding the timeframe an investor must maintain their investment to establish eligibility for classification under INA 203(b)(5) and to subsequently remove the conditions on their lawful permanent resident (LPR) status under INA 216A. Specifically, INA 203(b)(5)(A)(i) states that, to be eligible for classification, the investment must be “expected to remain invested for not less than 2 years” while INA 216A, as amended by the RIA, no longer requires that the investor sustain their investment throughout their period of conditional residence. Pursuant to Sec. 104(b)(2)(B) of the RIA, however, the removal of the sustainment requirement from INA 216A by the RIA does not apply to investors seeking to remove conditions under INA 216A based on a Form I-526 petition filed prior to enactment of the RIA. Consequently, investors who filed Form I-526 petitions prior to enactment of the RIA must sustain their investment throughout the two-year period of their conditional residence to be eligible for removal of conditions on their permanent resident status.

2. How long must an investment “remain invested” for Form I-526 and I-526E petitions filed on or after March 15, 2022?

An investor filing an EB-5 immigrant visa petition must have invested, or be in the process of investing, the required amount of capital in a new commercial enterprise in the United States and expect to maintain that investment for not less than 2 years, provided job creation requirements have been met. Though the statute does not explicitly specify when the 2 year period under INA 203(b)(5)(A)(i) begins, we interpret the start date to be the date that the full amount of qualifying investment is made to the new commercial enterprise and placed at risk under applicable requirements, including being made available to the job creating entity, as appropriate. If the investor invested more than 2 years before filing the Form I-526 or Form I-526E petition, the investment should generally still be maintained at the time the Form I-526 or Form I-526E is properly filed, for us to appropriately evaluate eligibility.

3. How long is the required investment timeframe for Form I-829 approval?

Because of the changes made by the RIA, the required investment timeframes for removal of conditions will differ depending on whether the investor filed their underlying petition for classification before or after enactment of the RIA.

Pre-RIA Investors. Sec. 104(b)(2)(B) of the RIA explicitly provides that the amendments made by the RIA to INA 216A, including removal of the sustainment requirement, do not apply to investors seeking to remove conditions under INA 216A based on a Form I-526 petition filed prior to enactment of the RIA. RIA Section 105(c) similarly mandated that the Secretary “continue to adjudicate petitions and benefits under sections 203(b)(5) and 216A of the Immigration and Nationality Act (8 U.S.C. 1153(b)(5) and 1186b) during the implementation of this Act and the amendments made by this Act”. Accordingly we will adjudicate Form I-829 petitions associated with Form I-526 petitions filed before March 15, 2022, under the applicable eligibility requirements in place before the enactment of the RIA. Sustainment requirements for this population will remain tied to the 2-year conditional permanent resident period. Pre-RIA investors must sustain their investment “at risk” throughout the 2-year period of conditional permanent resident to be eligible for removal of conditions on their permanent resident status. The conditional permanent resident status begins at the time of adjustment to conditional permanent resident status if the investor is in the United States or at the time of admission to the United States if the investor was abroad. We will review all documentation to establish eligibility.

Post-RIA Investors. Form I-829 petitions based on I-526 and I-526E petitions filed on or after March 15, 2022 will be considered under the new INA 203(b)(5) and 216Arequirements, as amended by the RIA. For purposes of determining the date when the two-year period required by INA 203(b)(5)(A)(i) begins, we will generally use the date that the requisite amount of qualifying investment is made to the new commercial enterprise and placed at risk under applicable requirements, including being made available to the job creating entity, as appropriate. If the investor invested more than 2 years before filing the Form I-526 petition, the investment should generally still be maintained at the time the Form I-526 is properly filed, for us to appropriately evaluate eligibility.

4. Can an NCE retain an investor’s capital beyond the required investment timeframe? Does the INA place a limit on how long the capital can be retained before it must be returned to the investor?

The INA establishes only minimum required investment timeframes for purposes of applicable eligibility requirements and does not place any upward limit on how long an investor’s capital may be retained before being returned. Regional centers or their associated new commercial enterprises can negotiate longer periods of investment directly with their investors independently of EB-5 eligibility requirements.

5. For post-RIA investors, if the required 2-year investment period ends after their Form I-526 or I-526E is filed but before it is approved, can their investment capital be returned without affecting their immigrant petition (assuming job creation and all other eligibility requirements have been met)?

Likely yes, as we generally will use the date that the requisite amount of qualifying investment is made to the new commercial enterprise and placed at risk under applicable requirements, including being made available to the job creating entity, as appropriate.

6. For post-RIA investors, how long must their investment remain invested if they are actively in the process of creating the requisite employment under INA 216A?

Under INA 216A, as amended by the RIA, investors who have not yet created the requisite employment when filing for removal of conditions on their permanent resident status but who are actively in the process of doing so may be granted a discretionary one-year extension of their conditional permanent resident status. The investor’s capital must remain invested during such time, even if it is beyond the two-year minimum period contemplated by INA 203(b)(5)(A)(i).

7. How do pre-RIA direct/standalone investors sustain their investment if they are in a position to get their funds back but have not yet finished their conditional permanent resident period? On that topic, at what point does USCIS consider job creation requirements to be fulfilled for direct investors?

Pre-RIA investors will continue to be subject to pre-RIA requirements for removal of conditions; their sustainment period under INA 216A is tied to the two-year period of their conditional permanent residence. The investor’s investment capital must remain at risk in the new commercial enterprise throughout the 2-year sustainment period. If the investor’s capital was deployed in a manner such that it will not remain at risk before completing the 2-year sustainment period, the investment capital must be further deployed to remain at risk. The job creation requirement is separate from the sustainment requirement and may be fulfilled by the standalone investor when their new commercial enterprise creates the required 10 full-time qualifying direct jobs in the United States. Those jobs must be permanent and held by qualified employees. The creation or preservation of jobs must occur within 2 years of the investor’s conditional permanent residency and entrance into the United States.

Targeted Employment Areas (TEA) and Infrastructure Projects

8. Where in the adjudications process will designations of high unemployment areas and infrastructure projects take place?

For regional center cases, we will make these designations in adjudicating Form I-956F, Application for Approval of an Investment in a Commercial Enterprise.

For standalone cases, we will make these designations in adjudicating Form I-526, Immigrant Petition by Standalone Investor. By statute, the lower investment amount and visa set aside resulting from investment in an infrastructure project are limited to regional center-sponsored commercial enterprises. See Immigration and Nationality Act (INA) section 203(b)(5)(D)(iv)).

Application to Register Permanent Residence or Adjust Status (Form I-485)

9. Can I file a Form I-485, Application to Register Permanent Residence or Adjust Status, and Form I-526, Immigrant Petition by Standalone Investor, or Form I-526E, Immigrant Petition by Regional Center Investor, at the same time (“concurrent filing”)?

Yes, you can file Form I-485 and Form I-526 or Form I-526E concurrently if approval of your petition would make a visa immediately available to you. See INA section 245(n). If you have a pending Form I-526, including those filed before March 15, 2022, you may file a Form I-485 if you meet relevant requirements. Please refer to the Form I-485 page for additional information on Form I-485 filing requirements or consult an attorney before filing. Be sure to mail the forms to the address listed on this page: Direct Filing Addresses for Form I-526, Immigrant Petition by Alien Entrepreneur.

1. Is failing to comply with biometrics appointments a ground for denying a Form I-829 and removing conditional permanent resident status?

As part of administering immigration benefits, we may require any applicant, petitioner, sponsor, beneficiary, or individual filing a benefit request, or any group or class of such persons submitting requests, to appear for an interview or biometrics services, or for both. See 8 CFR 103.2(b)(9). Biometrics services may include fingerprints, photographs, or digital signatures. Biometrics permit us to verify a person’s identity, produce secure documents, and facilitate required background checks to protect national security and public safety and to ensure that the person is eligible for the benefit sought. If we require an individual to submit biometrics or appear for an interview or other in-person process but the person does not appear, we may consider the benefit request abandoned and deny the request unless, by the appointment time, we have received a notice of change of address or a request to reschedule that we believe warrants excusing the failure to appear. See 8 CFR 103.2(b)(13)(ii).

2. How should industry stakeholders, petitioners, applicants, and seekers of benefits under the immigrant visa program communicate with DHS about specific EB-5 cases or seek information that is not case-specific about the EB-5 program?

Section 107 of the RIA incorporates many of the same restrictions from the 2015 DHS EB-5 Ethics and Integrity Protocols. RIA mandates that DHS employees act impartially and not give preferential treatment to any entity, organization, or individual in connection with any aspect of the EB-5 program. It also mandates specific channels as the only channels or offices by which industry stakeholders, petitioners, applicants, and seekers of benefits under the EB-5 program may communicate with DHS about specific EB-5 cases (except for communication made by applicants and petitioners under regular adjudicatory procedures), or information that is not case-specific about the EB-5 program. In accordance with these requirements, we offer the following modes of communication:

- Email to USCIS.ImmigrantInvestorProgram@uscis.dhs.gov;

- Our Contact Center; and

- Our Office of Public Engagement.

3. Can EB-5 investors continue to pursue their immigrant visa petitions and receive benefits if their regional center is terminated for failure to pay the EB-5 Integrity Fund Fee, provided all other eligibility requirements are met?

Yes, EB-5 investors associated with a terminated regional center may retain eligibility and receive benefits under certain circumstances as provided by INA 203(b)(5)(M). However, pre-RIA investors and post-RIA investors may need to take different actions to retain their eligibility because of the different requirements and legal provisions that apply to them.

Pre-RIA investors may, in certain situations, remain eligible based on indirect jobs, as applicable to their petition before the RIA was enacted notwithstanding termination of their associated regional center. Accordingly, where regional center termination is based on failure to pay the EB-5 Integrity Fund fee, which would generally not otherwise directly affect or implicate the underlying investment or job creation, officers may generally determine, in their discretion and on a case-by-case basis, that a pre-RIA investor associated with a terminated regional center continues to be eligible for classification as an immigrant investor, despite the regional center termination and without the need to reassociate with another approved regional center or make an investment in another new commercial enterprise. Such determinations will be made in accordance with applicable USCIS policy regarding deference to prior determinations to ensure consistent adjudication. Also, USCIS will generally not consider such termination a material change that impacts continued eligibility. While regional center termination for failure to pay the required EB-5 Integrity Fund fee may generally not have an effect on pre-RIA investor eligibility in many, or even most, circumstances, it is certainly possible that an investor may invest with a regional center that both fails to pay the required EB-5 Integrity Fund fee and also have project-related eligibility concerns, such that petitioner eligibility is affected separate from the regional center’s termination for failure to pay the required EB-5 Integrity Fund fee. If the pre-RIA investor’s eligibility is affected, they may need to reassociate with another approved regional center or make an investment in another new commercial enterprise to retain eligibility under INA 203(b)(5)(M) since they may not continue to be eligible.

Post-RIA investors, however, are not subject to the same grandfathering provisions of the RIA as pre-RIA investors but are subject to the new requirements added by the RIA, such as the requirement under INA 204(a)(1)(H)(ii) to remain associated with an approved project application under INA 203(b)(5)(F) (Form I-956F). Consequently, post-RIA investors associated with a terminated regional center may retain their eligibility under INA 203(b)(5)(M) if:

- Their new commercial enterprise reassociates with another approved regional center (regardless of the regional center’s designated geographic area); or

- They make a qualifying investment in another new commercial enterprise. In either case, post-RIA investors should generally continue to be associated with an approved Form I-956F (filed by their new regional center for their existing new commercial enterprise or otherwise associated with the different new commercial enterprise into which they have invested) for purposes of remaining eligible under all applicable requirements.

USCIS will notify investors of the termination of their associated regional center, and impacted investors generally have 180 days after USCIS has provided them such notice to amend their petition to meet applicable eligibility requirements.

4. Is it possible for an immigrant investor who has invested their capital for the requisite time period and created the requisite number of jobs prior to obtaining lawful permanent resident status to become a lawful permanent resident without conditions under INA 216A, effectively skipping the conditional residence period?

No. The RIA did not change the requirement under INA 216A that all EB-5 investors obtain lawful permanent resident status on a conditional basis subject to having those conditions removed by satisfying applicable requirements under INA 216A. All EB-5 investors who obtain conditional permanent resident status subject to INA 216A must file a Form I-829 within the 90-day period immediately before the second anniversary of their adjustment of status or their admission to the United States as a conditional permanent resident to remove their conditions.

1. Why are these interpretations being announced via the USCIS website and not through notice and comment rulemaking procedures?

These updates interpret the Immigration and Nationality Act (INA) and the EB-5 Reform and Integrity Act of 2022 (RIA), and an agency is not required to use the Administrative Procedure Act’s (APA) notice-and-comment procedures to issue an interpretive rule or one that amends or repeals an existing interpretive rule, or when modifying rules of agency organization, procedure, or practice. See, for example, Perez v. Mortgage Bankers Assoc., 135 S. Ct. 1199 (2015). These updates and interpretations do not add to the substantive regulations, create legally binding rights, obligations, or change the substantive standards by which IPO will evaluate EB-5 petitions and applications. Rather, we have interpreted the investor eligibility investment sustainment as closely as practicable to the plain language of the RIA.

2. Are USCIS officers bound by this guidance?

This website guidance helps our officers in rendering decisions, and should generally be followed by officers in the performance of their duties but it does not remove their discretion in making adjudicatory decisions. This guidance and the interpretations do not create any substantive or procedural right or benefit that is legally enforceable by any party against the United States or its agencies or officers or any other person.

3. How will USCIS apply these provisions and has it considered the reliance interests of, and potential retroactive impacts to, EB-5 entities and petitioners who filed or were approved prior to the RIA?

Required Investment Timeframe. As intended by the RIA, we will apply the provisions of the INA applicable to required investment timeframes and amended by the RIA to EB-5 investors that file their Form I-526 or Form I-526E petitions on or after March 15, 2022. Forms I-829 based on Forms I-526 that were filed prior to March 15, 2022, will generally continue to be adjudicated under the prior statutory framework, as required by Sections 104(b)(2)(B) and 105(c) of the RIA. After a consideration of reliance interests and potential retroactive impacts, we believe the interpretations and guidance explained above provide flexibility and lessen the burdens on EB-5 entities.

Interpreting the start date for the 2-year investment period required under INA 203(b)(5)(A)(i) to be the date that the full amount of qualifying investment is made to the new commercial enterprise and placed at risk under applicable requirements, aligns most closely with the plain language of the statute. Additionally, for us to appropriately evaluate eligibility, the investment should generally still be maintained if the investor invested more than 2 years before filing the Form I-526 or Form I-526E petition.

We do not believe that there are reliance or retroactivity impacts with this interpretation, as it aligns closely with the plain language of the statute and applies to petitions filed on or after the effective date of the RIA. To the extent there may be interests at stake, we believe this interpretation lessens the burden on the investor to keep their investment in place for an extended period, due to circumstances beyond the investor’s or the NCE’s control, such as visa backlogs or other such circumstances. Further we believe it provides the greatest level of flexibility for stakeholders to create investment strategies, limits the need for NCEs to redeploy investor capital after sufficient jobs have been created, and provides the investor a significant degree of control.

INA 203(b)(5)(M). Interpreting INA 203(b)(5)(M) to apply to pre-RIA investors associated with a terminated regional center (or debarred new commercial enterprise or job-creating entity) is also in accordance with the plain language of the INA and its intent. Neither the RIA nor the INA differentiates between pre- or post-RIA investors for purposes of the protections afforded to good faith investors under INA 203(b)(5)(M). We recognize that applying a new provision of the INA added by the RIA to those who filed prior to its effective date could appear to be retroactive; however, we believe that this protects petitioner and applicant interests. Further, the relevant conduct covered by this provision, termination or debarment of an EB-5 entity, from which applicable legal consequences will flow will be applied only to terminations or debarment occurring after enactment of the RIA (in other words, we will apply this provision prospectively based on the conduct—termination or debarment—relevant to its application). More specifically, prior to the RIA, regional center investors had to show that their investment was within an approved regional center in order to demonstrate eligibility for their Forms I-526 petitions and, in line with these requirements, longstanding USCIS policy has considered the termination of a regional center associated with a regional center investor’s Form I-526 petition to constitute a material change that would generally result in ineligibility. Applying this provision for post-RIA terminations or debarments of associated EB-5 entities avoids significant adverse impact to pre-RIA petitioners whose eligibility could be impacted by post-RIA terminations or debarments and provides flexibilities for them to maintain eligibility.

As for notification deadlines, we have authority to extend certain deadlines under INA 203(b)(5)(M)(v)(II). We generally plan to extend the deadline for pre-RIA investors to respond to a regional center termination notification until Uwe adjudicate their petition. We recognize that this interpretation would not generally apply to post-RIA investors, however, we believe this is justifiable because there is a large volume of investors that could be affected by terminations of previously designated regional centers based solely on noncompliance with certain new administrative requirements added by the RIA and that this is unlikely to recur to the same degree and with the same considerations for post-RIA investors in the future. Specifically, before March 15, 2022, there were 632 regional centers and as of June 30, 2023, we have received only 357 Form I-956, Application for Regional Center Designation, applications or amendments for previously designated regional centers, and only 250 of previously designated regional centers have paid the Integrity Fund Fee. We interpret the RIA in a manner we hope permits good faith investors of terminated regional centers to retain their eligibility, and do not believe post-RIA investors will be under the same immediate constraints such that they would be prejudiced by interpreting and applying this flexibility to pre-RIA investors in this limited circumstance.

1. USCIS intends on publishing a “months of inventory” data point on the Form I-526, Immigrant Petition by Alien Investor (Legacy), processing times page. What does “months of inventory” mean?

“Months of Inventory” is a data point calculated by dividing the pending pre-EB-5 Reform and Integrity Act (RIA) Form I-526 inventory by the average number of pre-RIA Form I-526 completions per month during the past six months. We are adding this information because it paints a clearer picture of our progress for our stakeholder community.

2. Why does a Months of Inventory data point better reflect the work being done?

USCIS is no longer receiving Form I-526 legacy petitions, therefore, we are working through an inventory of cases that is not fluctuating due to the intake of additional receipts. While the processing time is based on how long it took us to complete 80% of adjudicated cases over the past six months, the Months of Inventory provides an additional data point of the progress toward reducing the current inventory of Form I-526 legacy petitions. For example, for the month of March 2024, the 80th percentile processing time was 54.5 months while the Months of Inventory was around 14 months. The Months of Inventory reflects the number of months of inventory that we have in any given month and will generally decrease month over month as we adjudicate these cases.

Each case is unique, however, and some cases may take longer than others. Processing times should be used as a reference point, not an absolute measure of how long your case will take to be completed.